Credit cards are a popular financial tool that allow consumers to make purchases on credit and pay them back over time. There are many different types of credit cards available, each with its own set of features and benefits. One popular type of credit card is the travel rewards card, which allows users to earn points or miles that can be redeemed for travel-related expenses. Airline credit cards are a great way to earn rewards and perks while traveling. These cards offer a variety of benefits, including free checked bags, priority boarding, and access to airport lounges. With so many options available, it can be difficult to choose the best airline credit card for your needs. In this article, we will review the best airline credit cards of October 2023, based on overall consumer value and suitability for specific kinds of consumers and for flyers loyal to a specific airline.

Delta SkyMiles Gold American Express Card

This card is best for airline credit cards. It offers a great sign-up bonus, priority boarding, and free checked bags. Cardholders can

also earn miles on everyday purchases and redeem them for flights, upgrades, and more. In addition, cardholders enjoy priority boarding, a free checked bag, and access to exclusive Delta Sky Club lounges. The annual fee is reasonable, making it an attractive

option for those who frequently fly with Delta. The card has a $0 introductory annual fee for the first year, then $99. Cardholders earn 2 miles per $1 spent on Delta purchases, at restaurants worldwide, and at U.S. supermarkets, and 1 mile per $1 spent on all other

purchases. New cardholders can earn 40,000 bonus miles after spending $1,000 on purchases in the first 3 months of account opening. Cardholders receive a free first checked bag on Delta flights, priority boarding, and 20% off inflight purchases.

Cardholders have access to the Global Assist Hotline, which provides medical, legal, and financial assistance when traveling more than 100 miles from home.

How to apply?

Apply here

United Explorer Card

The United Explorer Card is a solid choice for those who frequently fly with United Airlines and want to earn rewards for their purchases. It has a $0 introductory annual fee for the first year, then $95, and offers 1x-2x miles on purchases. The card also comes with a sign-up bonus of 60,000 miles when you spend $3,000 in the first three months of account opening. Other benefits include priority boarding, a free checked bag, and two United Club passes per year. The card is also a good companion to other cards in the Chase Ultimate Rewards family, as points can be transferred to this card from other cards that earn Chase Ultimate Rewards, potentially opening up more redemption options

How to apply?

Apply here

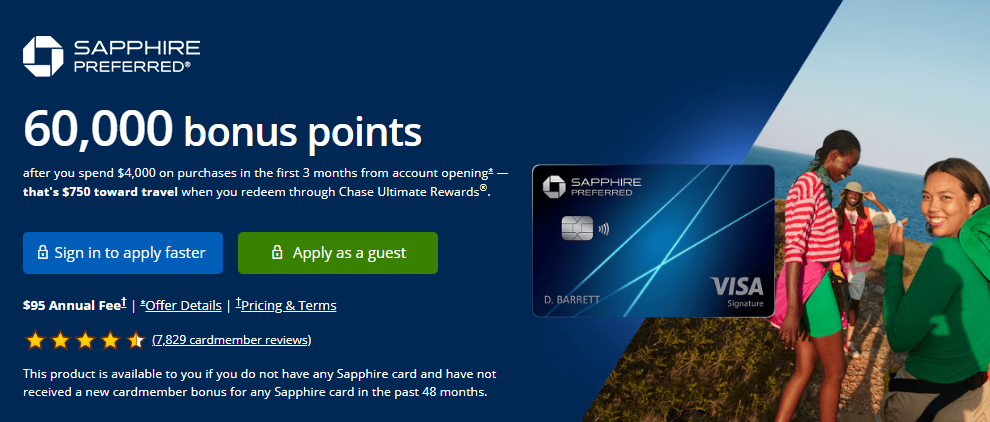

Chase Sapphire Preferred Card

One of the most popular travel rewards cards is the Chase Sapphire Preferred Card. This card offers a variety of benefits, including a

generous sign-up bonus, flexible redemption options, and travel perks like primary rental car insurance and trip cancellation/interruption insurance. The card has an annual fee of $95, which is waived for the first year. The Chase Sapphire Preferred Card is a great choice for travelers who want to earn rewards on their purchases and redeem them for travel-related expenses. The card offers a variety of redemption options, including travel through Chase Ultimate Rewards, transfers to airline and hotel partners, and cash back.

How to apply?

Apply here

Southwest Rapid Rewards Priority Credit Card

This card is best for domestic airline cards. It comes with an annual travel credit, a great anniversary bonus, and other perks that justify its annual fee. Cardholders can earn points on everyday purchases and redeem them for flights, hotel stays, and more. The card has an annual fee of $149. Cardholders earn 2 points per $1 spent on Southwest Airlines purchases and Rapid Rewards hotel and car rental partner purchases, and 1 point per $1 spent on all other purchases. New cardholders can earn 50,000 bonus points after spending $2,000 on purchases in the first 3 months of account opening. Cardholders receive a $75 Southwest annual travel credit, four upgraded boardings per year when available, 20% back on inflight purchases, and 7,500 anniversary points each year. Points can be redeemed for flights, hotel stays, car rentals, gift cards, and more. If you frequently fly Southwest Airlines, this credit card is worth considering.

How to apply?

Apply here

Alaska Airlines Visa Credit Card

The Alaska Airlines Visa Credit Card is a great option for those who frequently fly with Alaska Airlines. It offers a great sign-up bonus,

free checked bags, and priority boarding. Cardholders can also earn miles on everyday purchases and redeem them for flights, upgrades, and more. The card has an annual fee of $95. Cardholders can earn 1-3 miles per dollar spent, depending on the purchase

category. The card offers a sign-up bonus of 60,000 miles after spending $2,000 in the first 90 days. Cardholders can enjoy a free checked bag on Alaska Airlines flights, as well as an annual companion fare starting at $121.

How to apply?

Apply here

Aeroplan Credit Card

The Aeroplan Credit Card (from Air Canada) is a great option for those who frequently travel internationally. The card has a $95 annual fee and offers 1x-3x points on purchases. The card also has a sign-up bonus of 100,000 points when you spend a certain amount within the first few months of opening the account. The Aeroplan Credit Card is a great choice for those who want to earn points towards international travel, as the card offers a variety of redemption options. The card also offers travel perks such as travel insurance and airport lounge access. However, it’s important to note that the card may not be the best option for those who don’t travel frequently or who prefer cash-back rewards.

How to apply?

Apply here

Also read about Air Canada Gift Card

Delta SkyMiles Reserve American Express Card:

The Delta SkyMiles Reserve American Express Card is a premium airline card that offers a range of benefits for frequent travelers. The card has an annual fee of $550, but it comes with a variety of perks that can make it worth the cost for those who travel frequently. The Delta SkyMiles Reserve American Express Card offers a welcome bonus of 60,000 miles when you spend $4,000 in the first three months of card membership. Cardholders earn 3 miles per dollar spent on Delta purchases and 1 mile per dollar spent on all other purchases.

Cardholders receive complimentary access to Delta Sky Club lounges when traveling on a Delta flight. Cardholders receive priority boarding on Delta flights. Cardholders and up to eight companions on the same reservation receive their first checked bag free on Delta flights. Each year, upon renewal, cardholders receive a companion certificate that allows them to bring a companion on a domestic Delta flight for a reduced fee. Cardholders can earn up to 15,000 Medallion Qualification Miles (MQMs) per year through spending on the card. While the annual fee is high, the benefits can more than make up for it for those who use them frequently

How to apply?

Apply here

Delta SkyMiles Reserve Business American Express Card

The Delta SkyMiles Reserve Business American Express Card is a premium airline card designed for small businesses. It has an annual fee of $550 and offers 1x-3x miles on purchases. The card also comes with a welcome bonus of 100,000 miles when you spend $5,000 in the first three months of account opening. Other benefits of the card include access to Delta Sky Club lounges, a statement credit for Global Entry or TSA PreCheck, and a companion certificate each year upon renewal. The card also offers priority boarding, free checked bags, and in-flight savings on food, beverages, and entertainment.

Choosing the best airline credit card can greatly enhance your travel experience. By considering your travel habits and preferences, you can find a card that offers the rewards and perks you need. With the above mentioned cards, you can earn miles on everyday purchases and redeem them for flights, hotel stays, and more

How to apply?

Apply here